Stock Market Side Hustle: How I Made $2,000 in Dividends Last Month

As I reflect on my financial journey, I’m reminded of the power of dividend investing in creating a steady stream of passive income. The allure of earning regular dividends without having to actively work for it is a tantalizing prospect, especially in today’s volatile financial landscape.

Recently, I came across an inspiring story on Yahoo Finance about an investor who generated around $2,000 per month in dividends from a $500,000 investment. This anecdote resonated with me, as I’ve also been able to build a dividend portfolio that consistently yields a substantial monthly income.

Key Takeaways

- Dividend investing offers a reliable method for generating passive income.

- A well-structured dividend portfolio can provide a steady monthly income stream.

- Investing in established companies with a history of paying consistent dividends is crucial.

- A diversified portfolio can help mitigate risks associated with market volatility.

- Long-term commitment and patience are essential for maximizing dividend income.

My Journey to $2,000 in Monthly Dividend Income

As I reflect on my journey to achieving $2,000 in monthly dividend income, I realize that timing and strategy played crucial roles. My dividend investing journey began during a major market downturn when I recognized the opportunity to purchase quality stocks at significantly discounted prices.

How I Started Investing in Dividend Stocks

I started investing in dividend stocks with just a few hundred dollars per month from my primary income, focusing on companies with strong dividend histories. Similar to an investor who capitalized on the real estate crash, I took advantage of the COVID market crash to expand my dividend portfolio when solid companies were trading at bargain prices.

The Power of Dividend Growth Investing

The power of dividend growth investing became apparent when I noticed my dividend income increasing year after year without adding additional capital. I learned to identify companies with strong dividend growth histories, like those in the Dividend Aristocrats index that have increased dividends for 25+ consecutive years. Understanding the compounding effect of dividend reinvestment was a game-changer in accelerating my journey to $2,000 monthly income.

An investor once said,

“I got lucky with timing during the real estate crash… Moral of the story is TIMING is everything.”

This quote resonated with me as I navigated the world of dividend investing, emphasizing the importance of timing and strategic decision-making.

| Year | Dividend Income | Portfolio Value |

|---|---|---|

| 2020 | $1,000 | $250,000 |

| 2021 | $1,200 | $300,000 |

| 2022 | $2,000 | $500,000 |

My Stock Market Side Hustle Strategy

The key to my success in dividend investing lies in a three-pronged strategy that focuses on high-yield stocks, reinvestment, and market timing. This approach has been instrumental in helping me achieve my goal of $2,000 in monthly dividend income.

High-Yield Dividend Stocks

I focus on companies offering yields between 4-9%, significantly higher than the S&P 500 average. For more information on high-yield stocks, you can check out Investopedia’s guide on investing in stocks for long-term gains.

My portfolio balances between established dividend aristocrats with moderate yields and more aggressive high-yield options like REITs, MLPs, and certain ETFs.

Reinvesting Dividends for Compound Growth

The power of compound growth through dividend reinvestment has been crucial. I automatically reinvest all dividends to purchase additional shares, creating a snowball effect of increasing income.

This strategy accelerates wealth building by increasing your share count, which then generates more dividends, creating a virtuous cycle of growth.

Timing the Market During Downturns

Market timing has been another key element. I maintain a cash reserve specifically for increasing my positions during significant market corrections.

During the COVID crash, I deployed substantial capital into quality dividend stocks at discounted prices, significantly accelerating my journey to $2,000 monthly income.

Top 7 Dividend Stocks in My $2,000/Month Portfolio

To generate $2,000 monthly from dividends, I’ve curated a diverse portfolio of top dividend stocks. My investment strategy focuses on a mix of energy sector MLPs, real estate investment trusts (REITs), and specialized ETFs to ensure a steady income stream.

Energy Sector Winners

The energy sector forms a crucial part of my dividend income, with a focus on midstream companies that offer stable cash flows and high yields. These companies have less direct exposure to volatile oil and gas prices, making them more reliable for consistent dividend payments.

Enterprise Products Partners (EPD)

Enterprise Products Partners is a cornerstone of my energy holdings, offering a consistent yield of over 6%. With more than 25 years of distribution growth, EPD’s essential infrastructure generates reliable income regardless of energy price fluctuations.

Energy Transfer (ET)

Energy Transfer provides diversification within the energy sector with its extensive pipeline network and storage facilities. It offers a substantial yield above 8%, significantly contributing to my monthly dividend income.

Plains All American Pipeline (PAA)

Plains All American Pipeline rounds out my energy exposure with its 7.7% yield and strategic crude oil transportation assets. The company’s assets benefit from America’s energy production growth, making it a valuable component of my portfolio.

Real Estate Investment Trusts (REITs)

The REIT portion of my portfolio provides exposure to real estate without the challenges of direct property ownership. I focus on companies that pay monthly dividends, ensuring a steady income stream.

Realty Income (O)

Realty Income, known as “The Monthly Dividend Company,” has increased its dividend for over 25 consecutive years and pays monthly. This makes it an ideal stock for creating steady income streams.

Rithm Capital (RITM)

Rithm Capital offers exposure to the mortgage sector with its impressive 8% yield. This stock adds diversity to my REIT holdings and contributes to my monthly dividend income.

Starwood Property Trust (STWD)

Starwood Property Trust provides commercial real estate exposure with a substantial 9.7% yield. This stock is a significant contributor to my monthly dividend income and adds to the diversity of my REIT holdings.

ETFs for Steady Income

To further diversify my portfolio, I invest in specialized ETFs that use options strategies to generate high monthly income while maintaining exposure to quality stocks.

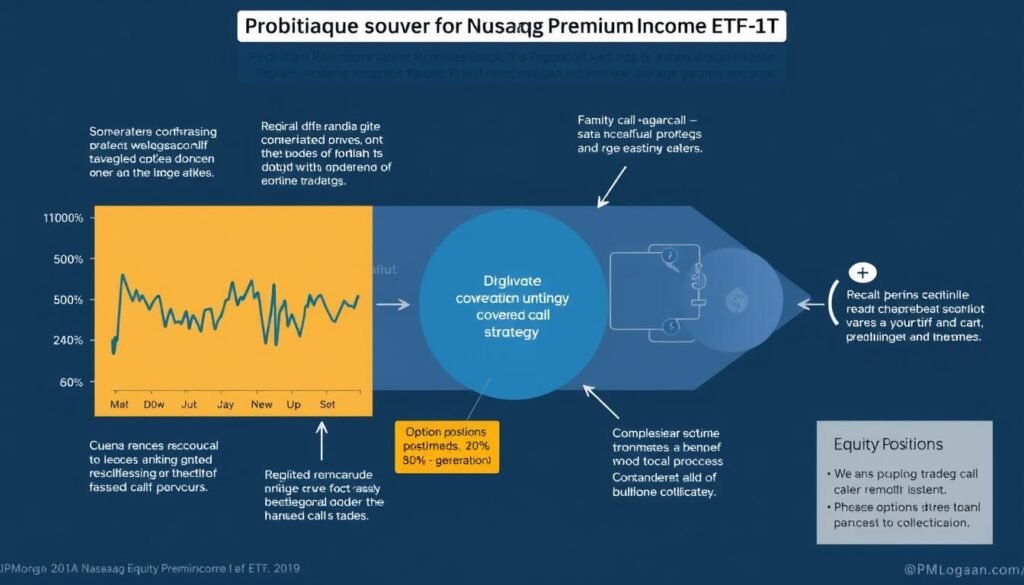

JPMorgan Equity Premium Income ETF (JEPI)

JEPI generates income through a combination of dividends from blue-chip stocks and premium income from selling options. This creates a steady monthly income stream, making it a valuable component of my portfolio.

JPMorgan Nasdaq Equity Premium Income ETF (JEPQ)

JEPQ complements JEPI by focusing on Nasdaq stocks, providing technology sector exposure while generating substantial monthly income through its covered call strategy.

Conclusion: How You Can Start Your Own Dividend Side Hustle

My journey to generating $2,000 in monthly dividends has taught me the importance of consistent investing and dividend growth stocks. To start your own dividend side hustle, it’s crucial to begin with a solid foundation.

Investing in Dividend Aristocrats – companies that have increased their dividends for 25+ consecutive years – can provide a reliable starting point. For those with limited capital, dividend-focused ETFs like SCHD, JEPI, or JEPQ offer instant diversification and monthly income.

Consistency is key; setting up automatic monthly investments, even as low as $100-200, can significantly impact your portfolio over time. It’s also vital to take advantage of market downturns by keeping cash reserves ready to invest in quality dividend stocks when they’re on sale.

Dividend reinvestment is another critical strategy for accelerating your journey. By setting up DRIP (Dividend Reinvestment Plans), you can automatically purchase additional shares with your dividend payments, compounding your wealth over time.

Building a $2,000 monthly dividend portfolio takes time and patience, but with the right strategy and consistent investment, it’s achievable. The beauty of this side hustle lies in its potential to generate consistent passive income with minimal ongoing maintenance.

By following these principles and maintaining a long-term perspective, you can create a thriving dividend side hustle that enhances your financial stability and freedom.

FAQ

What are dividend stocks and how do they generate income?

How do I get started with investing in dividend stocks?

What is the benefit of reinvesting dividends?

Are Real Estate Investment Trusts (REITs) a good investment for dividend income?

How do Exchange-Traded Funds (ETFs) work for dividend investing?

What is dividend yield, and how is it calculated?

Can dividend investing provide a stable source of income during market downturns?

editor's pick

latest video

news via inbox

Nulla turp dis cursus. Integer liberos euismod pretium faucibua