From Broke to $10K/Month: The Exact Strategy That Changed My Life

I still remember the struggles I faced financially, but my journey to achieving a consistent $10K monthly income was not an overnight success. It was a result of dedication, strategic planning, and a willingness to learn from my mistakes.

I’ve been through the cycle of financial struggle, and I’ve come out the other side. The strategy that worked for me isn’t a get-rich-quick scheme; it’s a proven roadmap based on my real-life experience. By sharing my story, I aim to show you that making $10,000 a month is achievable with the right approach.

My transformation wasn’t just about the money; it was about changing my mindset and approach to business and life. I had to develop my own path to financial success, and I’m here to share that journey with you.

Key Takeaways

- Discover the exact strategy that transformed my financial life.

- Learn how to apply real-life principles that led to my success.

- Understand the importance of mindset shifts in achieving financial goals.

- Find out how to develop a personalized approach to financial success.

- Gain insights into overcoming financial struggles and achieving consistency in income.

My Rock Bottom: Where My Journey Began

The struggles I faced during my financially darkest days ultimately paved the way for my future success. At 24, I was broke, working multiple jobs just to make ends meet, but still struggling to get ahead financially. It was a frustrating cycle that had been going on for years, affecting every aspect of my life, from my mental health to my relationships.

The specific financial problems I faced were daunting. Despite working constantly, I found myself drowning in debt with no clear way out. It was a painful reality that I couldn’t ignore any longer. The moment of truth came when I realized that what was holding me back wasn’t just external circumstances but also my own limiting beliefs about money and success.

- I was working hard but not getting ahead financially.

- My financial situation was affecting my mental health and relationships.

- I had to confront my limiting beliefs about money and success.

- The experience became a foundation for my future success.

- It forced me to rethink my approach to making money and managing my time more effectively.

Hitting rock bottom was a turning point. It was a difficult time, but it became a blessing in disguise. It forced me to completely rethink my approach to making money and to find new, more effective strategies. This journey, though painful, taught me invaluable lessons that I will carry with me for the rest of my life.

The Mindset Shift That Started Everything

Realizing that my beliefs about money were holding me back was the first step towards financial freedom. For a long time, I struggled financially, not because I lacked the right strategies, but because my mindset was not aligned with success. The journey to financial stability is often rooted in a change of perspective, and mine began with understanding the importance of reshaping my beliefs about wealth and life.

Dan Martell emphasizes that real transformation doesn’t start with what you do, it starts with what you believe about yourself. This resonated deeply with me as I reflected on how I had rebranded my life multiple times. I had to unlearn many of the limiting beliefs I had absorbed from people around me who were also struggling financially. The moment I realized that my mindset was the foundation that would either support or sabotage any strategy I tried to implement was a turning point.

I discovered specific mental frameworks that allowed me to see opportunities where I previously only saw obstacles. One of the key resources that helped me reshape my thinking about wealth and success was reading books on personal development and finance. This new approach didn’t just affect my finances but transformed my entire life, from my daily habits to my long-term vision.

| Mindset Shift | Old Beliefs | New Beliefs |

|---|---|---|

| Financial Perception | Money is scarce | Opportunities for wealth creation are abundant |

| Self-Perception | I am not capable of managing large finances | I am competent and capable of financial management |

| Risk Tolerance | Avoid risk at all costs | Calculated risk-taking is necessary for growth |

Implementing daily practices such as journaling and meditation helped reinforce this new mindset and prevented me from slipping back into old thought patterns. This journey wasn’t easy; it required consistent effort and a willingness to challenge my existing beliefs. The book that had a significant impact was one that taught me about the power of mindset in achieving success. It changed everything in my approach to making money and living a fulfilling life.

Why Traditional Advice Wasn’t Working For Me

It took me a while to understand why the standard financial advice wasn’t working for my business. I had been following the conventional wisdom, grinding 24/7, but still, I wasn’t seeing the results I wanted. The problem was, most of the traditional advice was designed for people who already had a stable income, not for someone starting from scratch like me.

The standard “save more, spend less” wisdom wasn’t addressing the real problem in my financial life. I wasn’t just looking for ways to cut back on expenses; I needed a solution that would help me generate more money. I was frustrated with the generic advice that ignored the realities of my circumstances and the specific challenges I was facing.

- I was overwhelmed by information overload, constantly jumping from one strategy to another without seeing any significant progress.

- The conventional wisdom about “working harder” was keeping me stuck in a cycle of burnout and minimal progress, wasting precious time.

- I realized that traditional business advice wasn’t applicable to my situation, and I had to find a different path that worked for my specific circumstances.

- I was spending too much time trying to find the “perfect” strategy instead of focusing on an approach that worked specifically for me and my goals.

In my journey, I learned that the key was not to follow generic advice but to understand what worked for me and my business. By doing so, I was able to break free from the cycle of frustration and start making progress.

From Broke to $10K/Month: The Exact Strategy That Changed My Life

My journey from being broke to earning $10,000 per month was not a result of luck, but a strategic shift in my business approach. This transformation involved several key components that worked together to produce remarkable results.

Identifying My Unique Value Proposition

To start, I focused on identifying my unique value proposition. This involved analyzing what I was naturally good at and what people were already asking me for help with. By understanding my strengths and the needs of my potential clients, I was able to position myself in the market effectively. This step was crucial as it allowed me to differentiate myself from others and attract clients who were willing to pay for my services.

For instance, I realized that my ability to provide strategic business advice was highly valued by my clients. By focusing on this strength, I was able to create a niche for myself and attract high-paying clients.

Creating High-Ticket Offers Instead of Low-Priced Products

Another critical shift was from trying to sell low-priced products to creating high-ticket offers. As Dan Martell emphasizes, one client paying $2,500 per month is equivalent to 500 subscribers paying $5 per month. This approach not only increased my earning potential but also allowed me to deliver more value to my clients. By structuring my offers to provide maximum value, I was able to attract clients who were willing to pay premium prices.

Building Leverage Through Systems

Finally, I worked on building leverage through systems. By creating a well-structured system, I was able to scale my income without proportionally increasing my work hours. This was achieved by implementing efficient processes and leveraging technology to automate repetitive tasks. As a result, I was able to maximize my time and increase my earning potential.

| Strategy Component | Description | Impact |

|---|---|---|

| Unique Value Proposition | Identifying strengths and market needs | Differentiation and client attraction |

| High-Ticket Offers | Creating premium services | Increased earning potential |

| Leverage Through Systems | Implementing efficient processes | Scalability and time maximization |

By combining these three components, I was able to create a sustainable path to achieving $10,000 per month. This strategy not only transformed my financial situation but also provided a framework for continued growth and success.

The First 30 Days: Getting Immediate Traction

The first 30 days of implementing my new business strategy were crucial in gaining immediate traction. During this period, I focused on taking action and executing the steps that would drive results for my business.

I started by identifying the specific activities that would generate sales and prioritizing them to maximize productivity during the first month. I structured my time efficiently, ensuring that I was focusing on revenue-generating activities that would bring in money.

To track my progress, I monitored certain metrics daily. This allowed me to adjust my approach based on real-time feedback, making sure I was on the right track. I maintained a positive mindset throughout this challenging period, pushing through obstacles and staying committed to my goals.

One of the significant achievements during this period was securing my first high-ticket client. The approach I used for this crucial sale was tailored to the client’s needs, and it was a significant milestone for my business. I leveraged this early win to build momentum, and it became the foundation for future growth.

I was transparent about both the successes and failures during the first 30 days. Understanding that imperfect action beats perfect planning, I continued to take consistent action and adjust my strategy as needed. By the end of the month, I had gained significant traction, which set the stage for further growth.

The experience and insights gained during this initial period were invaluable. They not only helped me in achieving immediate results but also paved the way for scaling my business in the subsequent months.

Scaling From $1K to $5K Per Month

Scaling from $1,000 to $5,000 per month was not just about increasing income; it was about transforming my business model to accommodate growth and increased client demands. This critical phase of my entrepreneurial journey taught me the importance of adapting strategies to suit different stages of business growth.

One of the key steps I took was refining my offers based on client feedback. This not only improved my conversion rate but also significantly enhanced client results. By understanding what my clients truly valued, I was able to tailor my services to meet their needs more effectively.

To manage the growing client load efficiently, I began systematizing parts of my business. This involved creating processes that could be repeated and improved over time, allowing me to focus on high-leverage activities such as finding more qualified prospects and improving my sales process.

Finding more qualified prospects was crucial during this phase. I achieved this by refining my marketing efforts and leveraging networks that provided high-quality leads. Additionally, I worked on improving my sales process to close deals more consistently, which involved developing a more nuanced understanding of client needs and presenting my services in a more compelling manner.

Managing my time effectively was also vital. As my business grew, so did the demands on my time. I had to prioritize tasks that drove growth and delegate or eliminate tasks that did not. This strategic time management helped me avoid the common plateau that many entrepreneurs hit around the $3K mark.

| Strategy | Impact | Outcome |

|---|---|---|

| Refining Offers | Improved Conversion Rate | Better Client Results |

| Systematizing Business | Increased Efficiency | Scalable Growth |

| Diversifying Income Streams | Reduced Financial Risk | Increased Stability |

Diversifying my income streams was another critical strategy during this phase. By not relying on a single revenue source, I was able to create a more stable financial foundation for my business. This involved exploring different service offerings, product-based revenue, and even passive income opportunities.

In conclusion, scaling from $1,000 to $5,000 per month required a multifaceted approach that included refining my offers, systematizing my business, and diversifying my income streams. By implementing these strategies, I was able to achieve significant growth while maintaining a stable and efficient business operation.

Breaking Through to $10K Consistently

Consistently earning $10,000 per month was a milestone that required a combination of strategy, mindset shifts, and leveraging my business. After crossing the $5K threshold, I understood that further growth would not be linear; it demanded a more nuanced approach.

To break through to $10K consistently, I had to restructure my business model to support this higher income level without sacrificing my personal time or burning out. This involved identifying and leveraging key areas in my business that could generate exponential growth rather than linear growth.

One of the key strategies I implemented was creating predictable income streams. By doing so, I was able to reduce the feast-or-famine cycle that many entrepreneurs face. This not only provided stability but also allowed me to plan for the future with greater certainty.

I also refined my client acquisition process to attract higher-quality clients who were a perfect fit for my premium offers. This shift not only increased my income but also enhanced the overall quality of my work, as I was working with clients who valued my services.

To maximize my effectiveness, I implemented productivity systems that ensured I was focusing on the highest-value work. This involved streamlining my workflow, eliminating non-essential tasks, and leveraging tools that could automate repetitive processes.

At this level, it was crucial to overcome certain psychological barriers that could limit my success. I had to believe that achieving $10K per month was sustainable for me and that I had the strategies in place to maintain it.

Maintaining consistency became the key to my ongoing success. It required a mindset shift towards long-term thinking rather than short-term gains. For more insights on creating consistent income, you can check out my guide on earning $3000 monthly by creating content.

In conclusion, breaking through to $10K consistently required a multifaceted approach that included strategic planning, leveraging my business, and maintaining a consistent mindset. By implementing these strategies, I was able to achieve and maintain a higher level of income.

- I detailed specific strategies to break through the $5K ceiling and hit $10,000 per month.

- I overcame psychological barriers to believe in the sustainability of this level of success.

- I restructured my business model for higher income without burnout.

- I identified leverage points for exponential growth.

- I created predictable income streams to reduce income fluctuations.

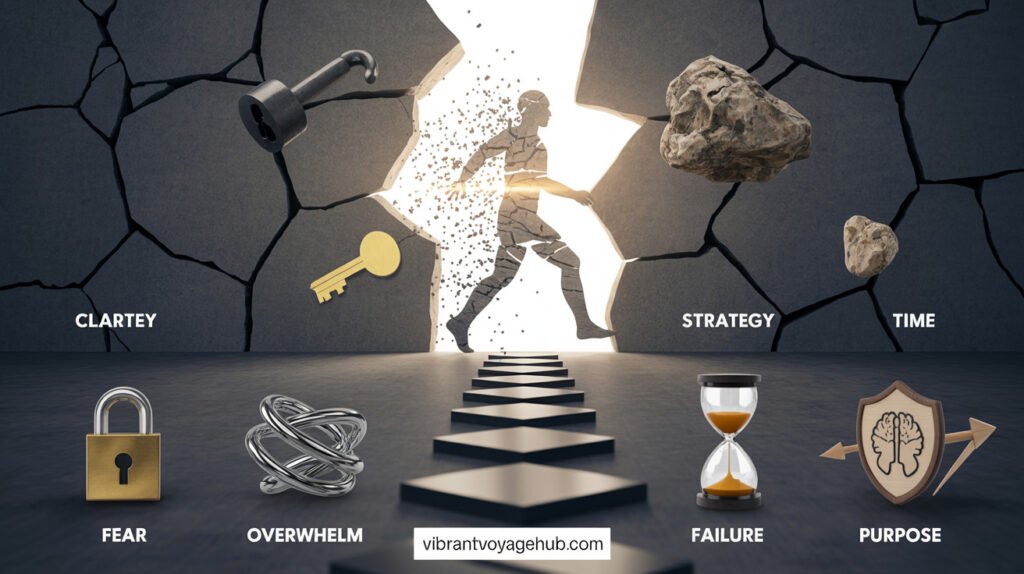

The Biggest Obstacles I Had to Overcome

The road to achieving $10K/month was fraught with challenges, but it was overcoming these obstacles that ultimately led to my success. As I reflect on my journey, I realize that the biggest hurdles were not just external but also internal.

One of the most significant internal barriers I faced was self-doubt and imposter syndrome. There were times when I felt like I wasn’t good enough or that my success was just a fluke. However, I learned to push through these feelings by focusing on my strengths and the value I provided to my clients.

Externally, one of the biggest obstacles was the fear of rejection when pitching high-ticket offers to potential clients. I had to develop a strategy to overcome this fear, which involved understanding that rejection was not personal and that it was a natural part of the sales process.

I also had to navigate the opinions of people who didn’t understand or support my new direction. This included friends and family who were skeptical about my ability to succeed. I learned to stay focused on my goals and not let the opinions of others hold me back.

As I scaled my business, I encountered new problems that I had to solve, from delivery issues to client management. I had to be proactive in identifying these problems and finding solutions to ensure that my business continued to grow.

| Obstacle | Strategy to Overcome |

|---|---|

| Self-doubt and Imposter Syndrome | Focusing on strengths and the value provided to clients |

| Fear of Rejection | Understanding that rejection is not personal and part of the sales process |

| Negative Opinions from Others | Staying focused on goals and not letting others hold you back |

| Business Problems (Delivery, Client Management) | Proactive identification and solution-finding |

Maintaining motivation during difficult periods was also crucial. I achieved this by celebrating small wins and reminding myself of my why. As the game changed at different income levels, I adapted my approach to meet new challenges, ensuring continued growth and success.

Creating Multiple Income Streams for Stability

My journey to $10K months wasn’t just about increasing my income; it was also about creating a stable financial foundation through diversification. To achieve this, I focused on creating multiple income streams that worked together synergistically.

By diversifying my revenue sources, I was able to reduce my dependence on a single income stream, thereby minimizing the risk of income volatility. This strategic decision enabled me to maintain a stable financial position, even when faced with challenges in one area of my business.

Service-Based Revenue

I started by building service-based revenue through high-ticket client work and consulting. This not only provided a foundation for my monthly income but also allowed me to work closely with clients, understand their needs, and develop tailored solutions. By focusing on high-ticket services, I was able to maximize my earnings while minimizing the number of clients I needed to serve.

Product-Based Revenue

In addition to service-based revenue, I developed product-based revenue streams that complemented my services. By creating products that addressed the needs of my clients at different price points, I was able to expand my reach and increase my revenue. This approach allowed me to cater to a broader audience, from those who were just starting out to those who were looking for more advanced solutions.

Passive Income Opportunities

I also explored passive income opportunities, leveraging my existing content and expertise to create ongoing revenue. By creating digital products, such as online courses and e-books, I was able to generate income without being actively involved in every transaction. This not only provided a relatively stable source of income but also allowed me to focus on other areas of my business.

To illustrate the impact of diversification on my income, consider the following table:

| Income Stream | Initial Revenue | Revenue After 6 Months |

|---|---|---|

| Service-Based | $1,000 | $5,000 |

| Product-Based | $500 | $3,000 |

| Passive Income | $0 | $2,000 |

| Total | $1,500 | $10,000 |

As shown in the table, diversifying my income streams led to a significant increase in my total revenue over a period of six months. By creating multiple income streams, I was able to achieve the stability and financial security that I needed to grow my business.

How This Strategy Changed More Than Just My Finances

Achieving financial stability was a turning point that changed not just my financial situation, but my entire approach tolifeandbusiness. As I reflect on my journey, I realize that the impact of thisstrategywent far beyond just increasing my income.

First and foremost, my relationships withpeopleimproved significantly once I achieved financial stability. I was able to show up differently for my loved ones, and the reduction in stress allowed me to be more present in my personal and professional life. I was no longer consumed by financial worries, and this freedom allowed me to nurture my relationships.

The decrease in daily stress levels had a dramatic positive impact on my physical and mental health. I was able to make decisions based on what I truly wanted, rather than what I could afford. This newfound freedom allowed me to investtimein activities that brought me joy and fulfillment.

As I mastered thisstrategy, my confidence grew, and I was able to take on new challenges inbusinessandlife. I started creating morecontentthat helped morepeople, which further reinforced my sense of purpose. I also began to invest in personal growth throughbooks, courses, and experiences that accelerated my success.

My perspective ontimechanged once I wasn’t constantly worried about money. I was able to achieve a better balance inlife, and this allowed me to design mylifearound my priorities rather than being dictated by financial necessity. I started reading morebooksthat helped me grow both personally and professionally, and I was able to manage mytimemore effectively.

In conclusion, the impact of thisstrategyon mylifehas been profound. It has allowed me to create a more balanced and fulfillinglife, and I have been able to help morepeoplethrough mycontentandbusiness. I have also had the opportunity to read morebooksand invest in my personal growth.

Conclusion: Your Path to $10K/Month

As I reflect on my journey from being broke to making $10K/month, I’m reminded that success is within reach. The key is applying the right strategies and maintaining a growth-oriented mindset. To achieve this, I’ve outlined several crucial steps that you can follow.

First, identifying your unique value proposition is vital. This involves understanding what sets you apart and how you can offer value to your clients. Second, creating high-ticket offers instead of low-priced products can significantly boost your income. Lastly, building leverage through systems ensures that your business can run efficiently without being overly dependent on your direct involvement.

To support your journey, I offer various resources, including my book, “Buy Back Your Time”, and a coaching program designed to help entrepreneurs scale their businesses. Thousands have already transformed their financial situations using these strategies, and I’m confident you can too.

Take the next step by scheduling a strategy call or joining my coaching community. While the path to $10K/month isn’t always easy, the results are game-changing. With the right strategy and mindset, you can achieve financial success and transform your life.

## FAQ

### Q: What is the most significant factor that holds business owners back from achieving their income goals?

A: For many entrepreneurs, a major obstacle is their mindset. Often, it’s not just about making money, but also about overcoming the limitations and beliefs that are holding them back. Shifting your mindset towards a more growth-oriented and sales-focused approach can be a game-changer.

### Q: How do you identify your unique value proposition, and why is it crucial for business success?

A: Identifying your unique value proposition involves understanding what sets your business apart and the value you bring to your clients. It’s essential because it allows you to create high-ticket offers that resonate with your target audience, ultimately driving more significant revenue and growth.

### Q: What is the importance of creating systems in a business, and how can it help in scaling income?

A: Building systems is vital for creating leverage in your business. By implementing efficient systems, you can automate tasks, reduce workload, and increase productivity, allowing you to scale your income without being directly involved in every aspect of the business.

### Q: How can entrepreneurs overcome the problem of being stuck in a low-income bracket?

A: To break through to higher income levels, entrepreneurs need to focus on creating high-ticket offers, building leverage through systems, and adopting a sales-driven mindset. This approach enables businesses to generate more substantial revenue and achieve sustainable growth.

### Q: What role does coaching play in achieving business success, and how can it help entrepreneurs overcome their challenges?

A: Coaching can be a powerful tool for entrepreneurs, providing them with the guidance, support, and strategies needed to overcome obstacles and achieve their goals. A coach can help you develop a winning mindset, create effective sales strategies, and build a robust business system.

### Q: How can business owners create multiple income streams to ensure stability and increase their overall income?

A: By diversifying your income streams through service-based revenue, product-based revenue, and passive income opportunities, you can create a more stable financial foundation for your business. This approach allows you to mitigate risks and increase your overall income potential.

### Q: What are some common problems that entrepreneurs face when trying to scale their business, and how can they be addressed?

A: Entrepreneurs often face challenges such as limited mindset, ineffective sales strategies, and inefficient systems when trying to scale their business. By addressing these issues through coaching, training, and implementing proven strategies, entrepreneurs can overcome these obstacles and achieve their growth goals.

editor's pick

latest video

news via inbox

Nulla turp dis cursus. Integer liberos euismod pretium faucibua